The Semiconductor Production Equipment (SPE) market is critical to the manufacturing of semiconductors, which are essential components in a wide array of electronic devices, from smartphones and computers to automotive systems and industrial machinery. This market includes the tools and machinery used at various stages of semiconductor fabrication, such as wafer processing, testing, and packaging.

Key Components of the Semiconductor Production Equipment Market:

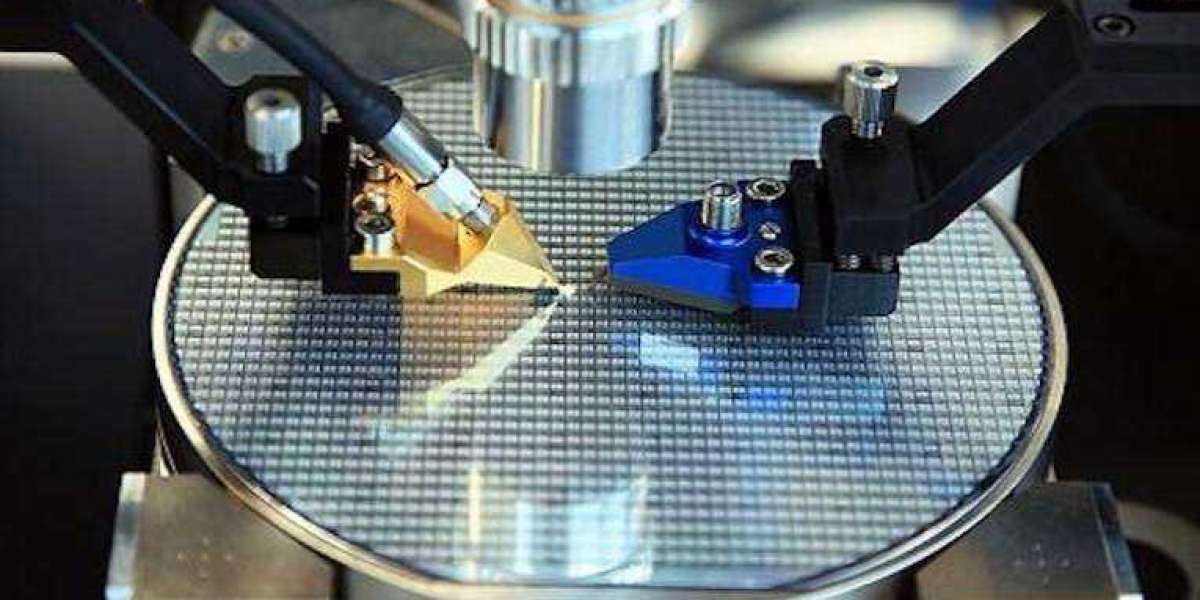

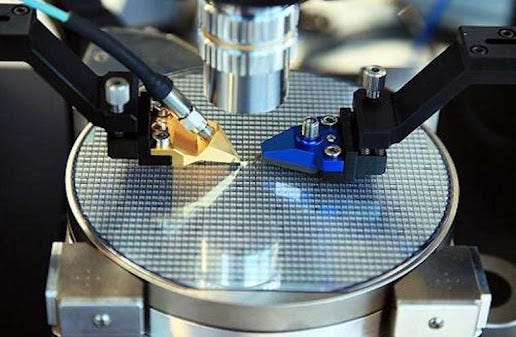

- Wafer Processing Equipment: This segment includes tools used in the front-end process of semiconductor manufacturing, where raw silicon wafers are transformed into integrated circuits (ICs). Key categories include:

- Photolithography Equipment: Machines that use light to transfer patterns onto the silicon wafer, a critical step in defining the circuit patterns.

- Etching Equipment: Tools that remove selected portions of material from the wafer to create the desired circuitry.

- Deposition Equipment: Systems that deposit thin layers of materials onto the wafer, forming the various layers of a semiconductor device.

- Chemical Mechanical Planarization (CMP) Equipment: Machines used to smooth and flatten the wafer surface, ensuring uniformity across the wafer.

- Assembly and Packaging Equipment: After wafer processing, semiconductors are cut into individual chips and then assembled and packaged. This segment includes:

- Die Bonders: Machines that attach the semiconductor die to a substrate or package.

- Wire Bonders: Equipment that connects the semiconductor die to its package via fine wires.

- Flip Chip Bonders: Tools that attach semiconductor dies directly to the package substrate using solder bumps.

- Testing Equipment: These machines test the functionality and performance of semiconductor devices to ensure they meet specifications before being shipped to customers. Key types include:

- Wafer Testers: Test equipment used to evaluate the electrical characteristics of the semiconductor devices while they are still on the wafer.

- Final Test Equipment: Systems that test completed semiconductor devices after they have been packaged.

- Other Equipment: This includes a range of support tools used in semiconductor manufacturing, such as:

- Cleaning Equipment: Systems that remove contaminants from wafers and other components during the manufacturing process.

- Metrology Equipment: Tools that measure and inspect semiconductor devices to ensure they meet design specifications.

Market Drivers:

- Growing Demand for Semiconductors: The rapid growth of industries like consumer electronics, automotive, telecommunications, and IoT is driving demand for semiconductors, which in turn fuels the need for advanced semiconductor production equipment.

- Advancements in Semiconductor Technology: The shift towards smaller, more powerful, and energy-efficient semiconductor devices, such as those built on 5nm or smaller process nodes, requires increasingly sophisticated and precise production equipment.

- Expansion of 5G and AI: The deployment of 5G networks and the growth of AI applications are leading to increased demand for high-performance semiconductors, spurring investment in advanced production equipment.

- Rise of Electric Vehicles (EVs): The automotive industry’s transition to electric vehicles, which require a significant number of semiconductors for battery management, powertrain systems, and autonomous driving features, is driving demand for semiconductor production equipment.

- Government Support and Investment: Governments worldwide are investing in the semiconductor industry, recognizing its strategic importance. These investments often include subsidies for semiconductor manufacturing facilities, driving demand for production equipment.

Challenges:

- High Capital Costs: Semiconductor production equipment is highly specialized and expensive, making the initial capital investment a significant barrier, especially for smaller manufacturers.

- Technological Complexity: As semiconductor technology advances, production equipment becomes more complex, requiring ongoing innovation and expertise, which can be challenging to maintain.

- Supply Chain Disruptions: The semiconductor industry is highly globalized, and disruptions in the supply chain, such as those caused by geopolitical tensions or pandemics, can significantly impact equipment availability and manufacturing timelines.

- Intellectual Property (IP) Risks: The development of semiconductor production equipment involves advanced technologies that are often protected by intellectual property. Protecting these innovations from theft or infringement is a constant challenge.

Market Size and Growth:

The Semiconductor Production Equipment market has been experiencing robust growth, driven by the increasing demand for semiconductors across various industries. The market was valued at approximately $70 billion in 2020 and is expected to reach around $120 billion by 2028, with a compound annual growth rate (CAGR) of about 6–8% during the forecast period from 2021 to 2028.

Major Players:

Key players in the Semiconductor Production Equipment market include:

- Applied Materials, Inc.

- ASML Holding N.V.

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

- Advantest Corporation

- Teradyne, Inc.

- Hitachi High-Technologies Corporation

- SCREEN Holdings Co., Ltd.

- Nikon Corporation

Future Outlook:

The future of the Semiconductor Production Equipment market is closely tied to ongoing advancements in semiconductor technology, particularly as the industry moves towards smaller process nodes and more complex device architectures like 3D stacking and chiplet design. The growing adoption of AI, 5G, IoT, and autonomous vehicles will continue to drive demand for advanced semiconductor devices, and by extension, the equipment needed to manufacture them.

Additionally, geopolitical factors, such as the push for semiconductor self-sufficiency in regions like the United States and Europe, are likely to spur further investment in semiconductor manufacturing capabilities, benefiting the production equipment market.

Sustainability will also become increasingly important, with manufacturers looking for equipment that not only meets performance requirements but also reduces energy consumption and waste.

Overall, the Semiconductor Production Equipment market is poised for sustained growth, supported by technological innovation, increasing semiconductor demand, and global investment in semiconductor manufacturing infrastructure.

Contact Us:

Zion Market Research

USA/Canada Toll Free: 1 (855) 465–4651

Newark: 1 (302) 444–0166

Web: https://www.zionmarketresearch.com/

Blog: https://zmrblog.com/

read other reports :

https://www.linkedin.com/pulse/ai-radiation-dosing-market-size-share-global-lbnzc

https://www.linkedin.com/pulse/mental-health-software-market-size-latest-reports-h21fc

https://www.linkedin.com/pulse/precision-medicine-software-market-newest-report-size-booming-ykbpc

https://www.linkedin.com/pulse/2028-latest-report-neuroscience-market-size-business-growth-6vmmc

https://www.linkedin.com/pulse/healthcare-information-exchange-hie-solutions-market-size-cmrcc