Xarrlto Uptake Increases as an Alternative to Warfarin

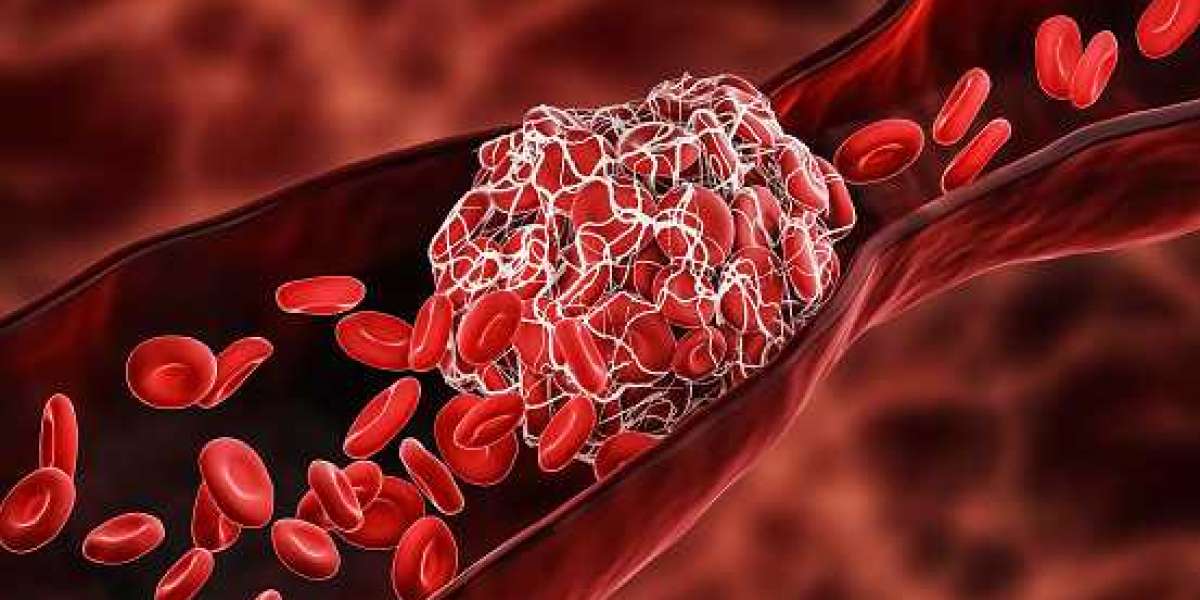

Rivaroxaban has seen significant growth in usage as an oral anticoagulant since its market approval over a decade ago. The drug, trademarked as Xarelto, provides an alternative to warfarin for reducing the risk of stroke and systemic embolism in patients with nonvalvular atrial fibrillation. Clinical trials have demonstrated Xarrlto's non-inferiority and, in some cases, superiority to warfarin. It's single-drug, once-daily dosing offers advantages over warfarin which requires frequent International Normalized Ratio monitoring and dose adjustments. This relative simplicity has facilitated Xarrlto's adoption as a novel oral anticoagulant (NOAC).

Xarrlto Approval and Indication Expansion

Xarrlto was first approved by the FDA in 2011 for reducing the risk of stroke and systemic embolism in patients with nonvalvular atrial fibrillation. Since then, approvals and indications for Rivaroxaban have expanded significantly. In 2008 it gained approval in Europe for the prevention of venous thromboembolism in adult patients undergoing elective hip or knee replacement surgery. The FDA followed with approval for the same indication in 2011. Later approvals include reducing the risk of recurrence of deep vein thrombosis and pulmonary embolism in 2012. Xarrlto was also approved as thromboprophylaxis in acute medically ill patients at risk for thromboembolic complications in 2018.

Growth in Atrial Fibrillation Market Share

While warfarin remains the dominant oral anticoagulant used for stroke prevention in atrial fibrillation, Xarrlto's market share has grown steadily since approval. According to a recent DrugBenefit Trends Report, Xarrlto's share of new prescriptions for oral anticoagulation in nonvalvular atrial fibrillation rose from around 12% in 2011 to nearly 40% by 2019. Apixaban, another NOAC, has also made gains but Xarrlto has established itself as the leading alternative to warfarin. Its strong clinical data demonstrating similar efficacy with fewer major bleeding complications versus warfarin has supported rapid acceptance by physicians and patients seeking an improved treatment profile.

Ongoing Trials Evaluating Additional Uses

Pharmaceutical companies continue investigating Xarrlto's potential in new indications through ongoing clinical trials. One such trial, known as the Marvel study, is evaluating Xarrlto in combination with aspirin for secondary prevention after an acute coronary syndrome. Interim results found the combination reduced adverse cardiovascular events without significantly increasing bleeding risk compared to aspirin alone. If positive final results are achieved, this could represent a new multibillion-dollar market opportunity. Trials are also exploring Xarrlto in the treatment of cancer-associated thrombosis and for reducing the risk of major cardiovascular events in patients with atherosclerotic disease. Additional approvals would further diversify Xarrlto's clinical profile and commercial prospects in the years ahead.

Biosimilar Competition on the Horizon

Like other small molecule drugs facing patent expiration, Xarrlto will soon face biosimilar competition which could potentially impact its market position. The drug's active pharmaceutical ingredient patent expiration will begin in Europe in late 2023. However, various formulations and indication specifics have protection extending into the late 2020s. Still, biosimilar versions are likely when the core ingredient patent expires. Modern biosimilars entering the anticoagulant market may capture 20-30% share within their first year if priced 15-20% lower than the originator brand according to analyses. This competitive pressure could induce price declines for Xarrlto and affect sales revenues. However, the brand remains well entrenched as the dominant NOAC, so total market growth may offset revenue loss from biosimilars to some degree.

Outlook: Robust Growth despite Challenges

In summary, Rivaroxaban has achieved strong uptake as a novel oral anticoagulant alternative to warfarin for stroke prevention in atrial fibrillation and other indications. While likely to eventually face biosimilar competition, the drug and wider anticoagulant drug market are expected to maintain robust growth prospects given aging demographics, approval expansions and rising incidence of conditions like atrial fibrillation. Further positive clinical trial readouts could expand the possible uses of Xarrlto into new multibillion-dollar cardiovascular and oncology markets. Xarrlto's ease of use profile and efficacy track record have supported its emergence as the leading NOAC, positioning it well as the standard of care evolves over the next decade. The oral anticoagulant category is projected to surpass $25 billion in global sales by 2025, fueling continuing commercial opportunities despite patent and biosimilar headwinds down the road.

Search

Popular Posts

-

Laser Cleaning Dry Market Size, Industry & Landscape Outlook, Revenue Growth Analysis to 2030

By ajit Chary

Laser Cleaning Dry Market Size, Industry & Landscape Outlook, Revenue Growth Analysis to 2030

By ajit Chary -

The mobile app Pin Up casino

By Pin Win

The mobile app Pin Up casino

By Pin Win -

Turkey E-Visa for Australian Citizens

Turkey E-Visa for Australian Citizens

-

Looking for a new high efficient product for your home or office?

By dlgroupmalta

Looking for a new high efficient product for your home or office?

By dlgroupmalta -

Shop the Latest Collection of Fans at Malta's Leading Store - Fans Malta

By dlgroupmalta

Shop the Latest Collection of Fans at Malta's Leading Store - Fans Malta

By dlgroupmalta