As the sun rises on September 10, all eyes are glued to the Indian stock market. Investors and traders alike are eager to decode the latest trends that could shape their financial decisions. The Nifty index stands at the forefront of this anticipation, serving as a key barometer for market performance. With its fluctuations often mirrored across sectors, understanding what lies ahead in terms of Nifty forecast is crucial for anyone diving into today’s trading activity. So, what can we expect? Let’s delve deeper into the intricacies of Nifty forecasts and explore how they impact your trading strategy!

What is Nifty Forecast?

Nifty forecast refers to the predictive analysis of the Nifty 50 index, which represents the top 50 stocks on the National Stock Exchange of India. This forecast aims to anticipate market movements based on various economic indicators and historical data.

Traders rely heavily on these forecasts to make informed decisions. It provides insights into potential price levels and trends that could emerge in the near term.

Factors such as global market conditions, domestic economic performance, and geopolitical events play a significant role in shaping these predictions. By analyzing charts and patterns, analysts create models that help investors understand where Nifty might head next.

With accurate forecasting, traders can optimize their strategies for buying or selling positions accordingly. Thus, grasping what a Nifty forecast entails is fundamental for anyone looking to navigate India’s dynamic stock market effectively.

Importance of Nifty Forecast in Trading

The Nifty forecast plays a pivotal role in trading strategies for investors. It provides insights into market trends and potential price movements, helping traders make informed decisions.

By analyzing the Nifty index, traders can gauge overall market sentiment. A positive forecast may signal bullish trends, while a negative outlook could indicate caution or bearish sentiments.

Moreover, understanding the Nifty forecast allows traders to set realistic targets. Knowing when to enter or exit positions can significantly impact profitability.

Risk management is another crucial aspect influenced by the Nifty forecast. Traders can adjust their strategies based on predicted volatility levels, minimizing losses during uncertain times.

Utilizing accurate forecasts enhances confidence in trading decisions. Investors who rely on well-researched predictions are often better positioned to navigate market fluctuations effectively.

How Nifty Index Affects the Market

The Nifty Index serves as a barometer for the health of the Indian stock market. It includes 50 major companies, making it a critical indicator of market trends.

When the Nifty rises, investor confidence typically grows. This can lead to increased buying activity across various sectors. A bullish sentiment often creates opportunities for traders and investors alike.

Conversely, when the Nifty faces downward pressure, fear can grip the market. Investors may rush to sell off shares, leading to broader declines in stock prices. This ripple effect impacts not just large-cap stocks but also mid and small-cap shares.

Additionally, global events or economic data releases can sway the Nifty dramatically. Changes in interest rates or geopolitical tensions often create volatility that affects trading decisions within this index.

Understanding these dynamics is essential for anyone looking to navigate India's complex financial landscape effectively.

Factors Influencing Nifty Forecast

Several key factors influence the Nifty forecast, shaping market sentiments and trading decisions. Macroeconomic indicators play a significant role. Factors such as GDP growth rates, inflation trends, and employment figures provide insights into economic health.

Global events also impact investor sentiment. Changes in international markets or geopolitical tensions can lead to fluctuations in the Nifty index. Traders often keep a close watch on global cues for guidance.

Another crucial element is corporate earnings reports. Strong performances from major companies can boost confidence and positively affect the index’s movement. Conversely, disappointing results may trigger sell-offs.

Government policies and regulations are vital considerations. Announcements related to taxation or trade can shift market dynamics significantly, influencing forecasts dramatically. Understanding these elements helps traders make informed decisions regarding their investments in the Indian stock market.

Recent Trends in Nifty Forecast

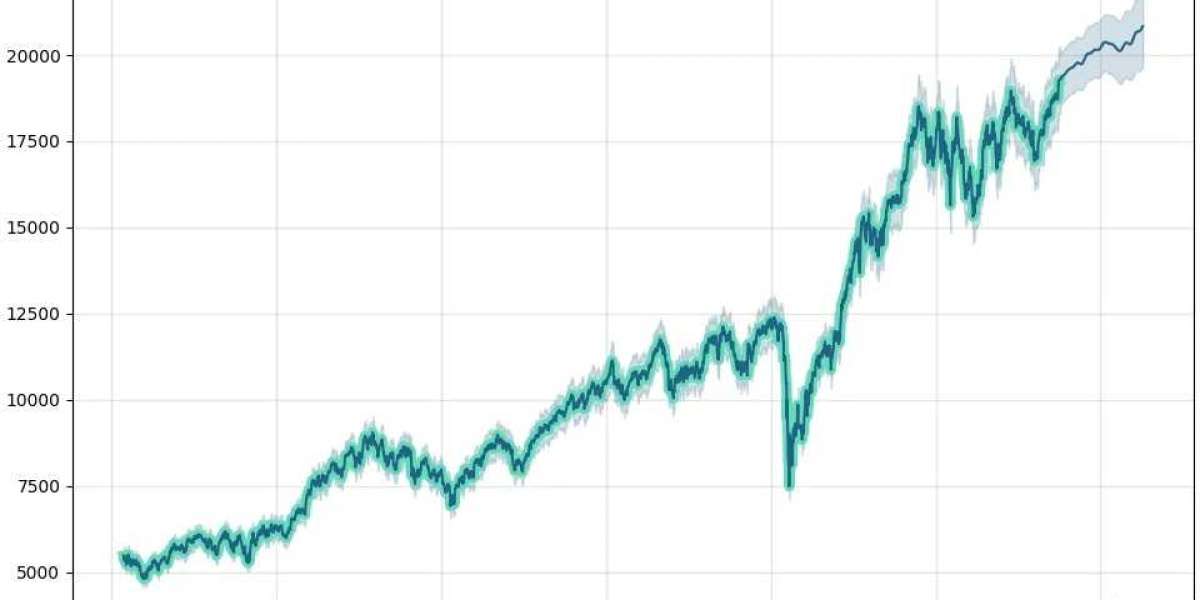

Recent trends in Nifty forecast indicate a landscape shaped by both volatility and opportunity. As economic indicators fluctuate, traders are closely monitoring the movements of this key index.

In recent weeks, an uptick in foreign institutional investments has been noted. This influx is often seen as a bullish sign, suggesting increased confidence among global investors in the Indian market.

Moreover, sectoral performance has varied significantly. Technology stocks have gained traction while traditional sectors like manufacturing face headwinds. Analysts are keen to assess how these shifts will influence overall market sentiment.

Technical analysis tools show mixed signals with resistance levels being tested frequently. Traders need to stay agile as conditions can change rapidly based on domestic and international developments.

Trading volumes remain robust, hinting at sustained interest from retail investors despite external pressures such as geopolitical tensions or inflation concerns.

Best Practices for Nifty Forecast

To make accurate Nifty forecasts, staying informed is crucial. Regularly follow financial news and updates that impact market sentiment. This helps in understanding the broader economic context.

Utilizing technical analysis tools can also enhance forecasting accuracy. Chart patterns, moving averages, and momentum indicators provide insights into potential price movements.

Incorporate fundamental analysis as well. Assess factors like corporate earnings reports and macroeconomic indicators to gauge overall market health.

Diversification of information sources is key too. Relying on multiple analysts or platforms can lead to a more rounded view of possible outcomes.

Emotional discipline should not be overlooked. Stick to your strategy even when market volatility creates uncertainty; this will help maintain clarity in your decision-making process during trading sessions.

Successful Forecasting Strategies

Successful forecasting strategies hinge on a few core principles. First, utilize a blend of technical and fundamental analysis. Technical indicators can provide insights into market trends, while fundamental data offers context about economic conditions.

Stay updated with global events. Geopolitical developments and macroeconomic changes often influence investor sentiment. Regularly monitoring news can enhance your forecasting accuracy.

Another key strategy is the use of historical data patterns. Analyzing past performances helps in identifying potential future movements within the Nifty index.

Diversification also plays a critical role. Don’t rely solely on one method or indicator; using various tools improves your chances of accurate predictions.

Maintain emotional discipline in trading decisions. Emotional reactions to market fluctuations can cloud judgment, so sticking to well-researched forecasts is essential for long-term success.

FAQs about Nifty forecast

What is the Nifty Index?

The Nifty Index, or Nifty 50, is a benchmark stock market index in India that includes 50 large and liquid companies listed on the NSE. It reflects the overall performance of the Indian stock market.

How often should I check Nifty forecasts?

It’s beneficial to review Nifty forecasts regularly, especially before making investment decisions. Keeping an eye on forecasts during major market events and earnings seasons is particularly important.

Can Nifty forecasts guarantee profits?

No, Nifty forecasts cannot guarantee profits. They provide insights based on historical data and current trends, but market conditions can change unexpectedly.

How can I improve my forecasting accuracy?

Improving forecasting accuracy involves using diverse analysis methods, staying updated with market news, and employing reliable tools. Additionally, learning from past forecasts and refining strategies based on performance can enhance accuracy.